The 7-Minute Rule for Offshore Trust Services

Wiki Article

The Best Strategy To Use For Offshore Trust Services

Table of ContentsGet This Report about Offshore Trust ServicesThe Ultimate Guide To Offshore Trust Services8 Easy Facts About Offshore Trust Services ExplainedNot known Incorrect Statements About Offshore Trust Services How Offshore Trust Services can Save You Time, Stress, and Money.How Offshore Trust Services can Save You Time, Stress, and Money.Getting My Offshore Trust Services To WorkHow Offshore Trust Services can Save You Time, Stress, and Money.

Personal lenders, also larger private firms, are extra amendable to resolve collections against debtors with complicated and reliable asset defense plans. There is no possession protection strategy that can discourage an extremely encouraged lender with limitless money and also patience, however a well-designed overseas count on commonly gives the borrower a beneficial negotiation.Trustee business bill annual costs in the array of $1,000 to $5,000 annually plus per hour rates for added services. Offshore depends on are except everybody. For most individuals residing in Florida, a domestic asset security strategy will be as effective for much less money. But also for some individuals facing challenging lender problems, the overseas depend on is the very best alternative to secure a significant amount of assets.

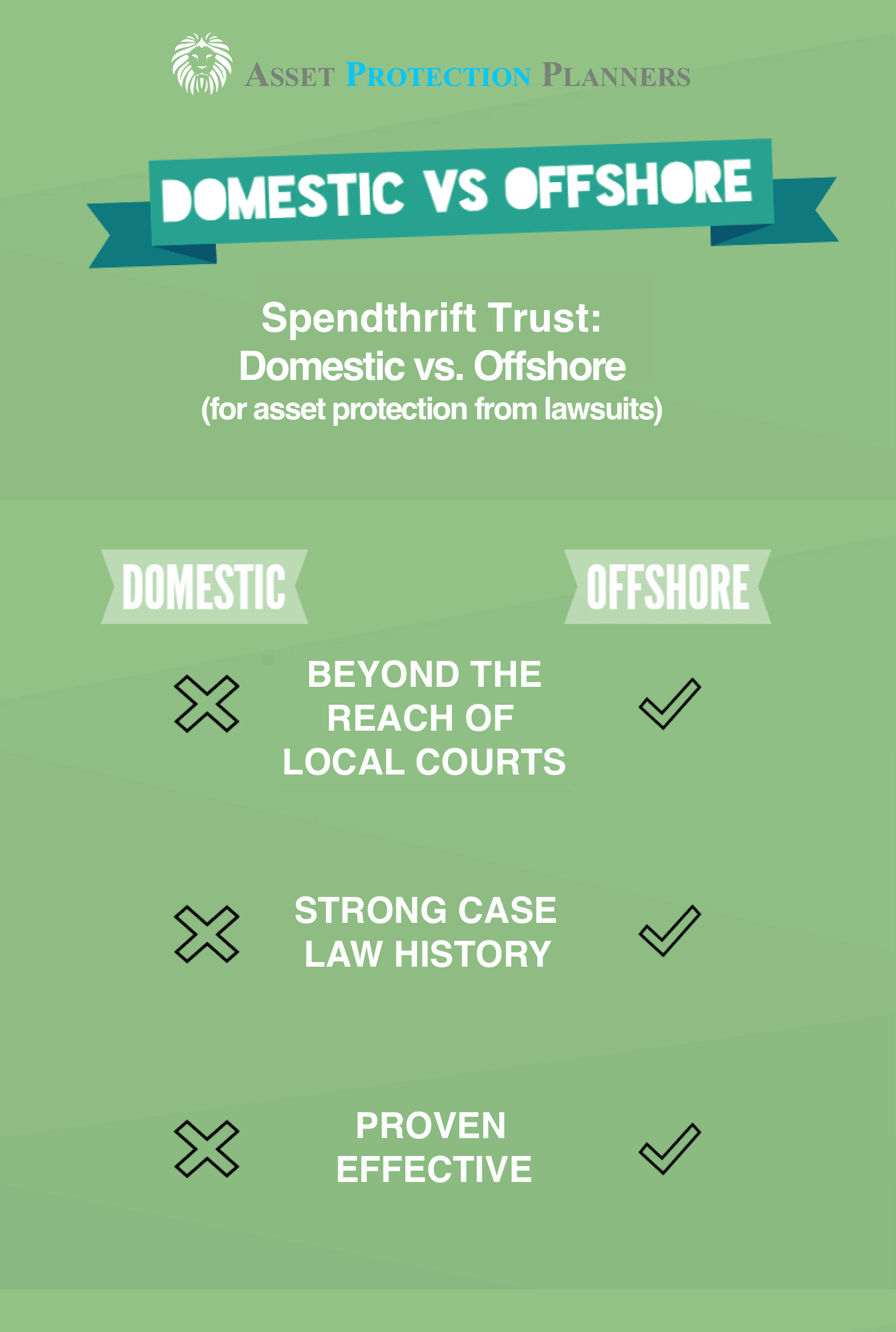

Debtors may have a lot more success with an overseas count on strategy in state court than in a bankruptcy court. Judgment financial institutions in state court lawsuits may be daunted by overseas asset security depends on as well as may not seek collection of assets in the hands of an overseas trustee. State courts do not have territory over overseas trustees, which means that state courts have restricted remedies to buy compliance with court orders.

Some Known Details About Offshore Trust Services

borrower data insolvency. A personal bankruptcy borrower should surrender all their possessions and also lawful interests in residential property any place held to the bankruptcy trustee. Insolvency courts have globally territory and are not hindered by international nations' rejection to identify general civil court orders from the united state. A united state insolvency judge might urge the personal bankruptcy borrower to do whatever is called for to transform over to the personal bankruptcy trustee all the debtor's properties throughout the globe, consisting of the debtor's valuable passion in an offshore depend on.Offshore possession protection depends on are much less efficient against IRS collection, criminal restitution judgments, as well as household sustain responsibilities. The courts might attempt to oblige a trustmaker to dissolve a trust fund or bring back trust properties.

The trustmaker has to be willing to quit legal civil liberties and control over their count on assets for an overseas depend successfully safeguard these possessions from U.S. judgments. 6. Selection of a specialist and reputable trustee who will certainly protect an overseas count on is more vital than selecting an offshore trust territory.

Offshore Trust Services Fundamentals Explained

Each of these countries has depend on statutes that agree with for offshore property protection. There are subtle legal distinctions among overseas depend on jurisdictions' legislations, but they have a lot more features alike. The trustmaker's selection of country depends mostly on where the trustmaker really feels most comfy placing possessions. Tax obligation treatment of international offshore counts on is very specialized.

Official statistics on trust funds are difficult to come by as in many offshore jurisdictions (as well as in a lot of onshore territories), trusts are not needed to be registered, however, it is believed that the most common use of overseas trusts is as part of the tax and also monetary planning of affluent individuals and also their households.

Indicators on Offshore Trust Services You Need To Know

In an Unalterable Offshore Count on might not be transformed or sold off by the settlor. A makes it possible for the trustee to choose the distribution of revenues for different classes of beneficiaries. In a Fixed trust, the circulation of earnings to the beneficiaries is dealt with and can not be transformed by trustee.Discretion and also privacy: Despite the fact that an offshore depend on is officially signed up in the federal government, the celebrations of the depend on, possessions, as well as the conditions of the count on are not tape-recorded in the register. Tax-exempt standing: Assets that are transferred to an offshore trust (in a tax-exempt offshore area) are not exhausted either when transferred to the depend on, or when moved or rearranged to the recipients.

How Offshore Trust Services can Save You Time, Stress, and Money.

This has additionally been done in a number of United state states., after that the trustees have to take a favorable role in the affairs on the firm., yet stays part of trust law in several typical regulation jurisdictions.Paradoxically, these specialist kinds of counts on appear to occasionally be utilized in regard to their initial desired usages. Celebrity counts on seem to be made use of a lot more regularly by hedge funds creating mutual funds as device counts on (where the fund supervisors desire to remove any type of responsibility advice to attend meetings of the firms in whose securities they invest) and VISTA trust funds are frequently utilized as reference a component of orphan frameworks in bond issues where the trustees desire to divorce themselves from overseeing the providing car.

An overseas trust is a tool utilized for asset security and estate planning that functions by moving properties right into the control of a lawful entity based in an additional nation. Offshore trust funds are irreversible, so trust proprietors can not reclaim ownership of moved possessions.

Offshore Trust Services Fundamentals Explained

Being offshore includes a layer of defense and privacy along with the ability to take care of taxes. For circumstances, since the depends on are not located in the USA, they do not have to adhere to U.S. legislations or the judgments of united state courts. This makes it harder for financial institutions and litigants to go after insurance claims versus assets kept in overseas trusts.It can be challenging for third celebrations to identify the properties and also proprietors of overseas trust funds, that makes them help to privacy. In order to establish an offshore count on, the initial step is to select a foreign nation in which to find the counts on. Some preferred locations include Belize, the Chef Islands, Nevis and Luxembourg.

Indicators on Offshore Trust Services You Need To Know

Transfer the properties that are to be safeguarded into the trust. Trust fund proprietors may initially produce a minimal responsibility business (LLC), transfer assets to the LLC and afterwards transfer the LLC to the trust fund. Offshore counts on can be valuable for estate preparation as well as property protection however they have restrictions.residents that establish overseas depends on can not run away all tax obligations. Earnings by assets placed in an overseas count on are without united state taxes. However U.S. residents that get circulations as beneficiaries do need to pay united state income tax obligations on the distributions. United state proprietors of overseas trust funds likewise need to submit reports with the Irs.

Unknown Facts About Offshore Trust Services

Corruption can be an issue in some nations. Furthermore, it is necessary to select a country that is not most likely to experience political agitation, routine modification, economic turmoil or fast adjustments to tax policies that might make an overseas trust fund much less useful. Ultimately, asset security trust funds generally have to be developed before they are required - offshore trust services.They also do not completely secure versus all claims and also might expose owners to risks of corruption and political instability in the host nations. Overseas trusts are valuable estate planning and also property security devices. Recognizing the ideal time to utilize a particular trust, as well as which count on would supply one of the most profit, can be complex.

An Offshore Count on is a customary Count on formed under the legislations of nil (or reduced) tax obligation Global Offshore Financial Facility. A Depend on is a legal strategy (similar to a contract) whereby one person (called the "Trustee") in accordance with a succeeding individual (called the "Settlor") authorizations to recognize and hold the home to assist various people (called the "Beneficiaries").

Report this wiki page